Ether Flips Bitcoin in Options Market for the First Time

Ether (ETH), the native token of Ethereum's blockchain, has overtaken industry leader bitcoin (BTC) in the options market for the first time on record.

As of writing, the cumulative dollar value of ether options contracts opens on dominant exchange Deribit was $5.7 billion, or 32% higher, than $4.3 billion locked in open bitcoin options trades. Deribit is the world's largest crypto-options exchange, accounting for more than 90% of the global total trading volume and open interest.

Open-options trades or open interest refers to the number of options contracts (call and put) traded but not squared off with an offsetting position. The notional open interest is calculated by multiplying the number of contracts open with the going spot market price of the underlying asset.

Ether's historic first lead over bitcoin in the options market comes as traders pile into ETH calls or bullish bets in the hope that Ethereum's impending merge would cause a 90% reduction in ETH issuance and bring a store of value appeal to the cryptocurrency. Merge, likely to happen in September, will combine Ethereum's current proof-of-work blockchain with a proof-of-stake blockchain called the Beacon Chain, which has been running since 2020.

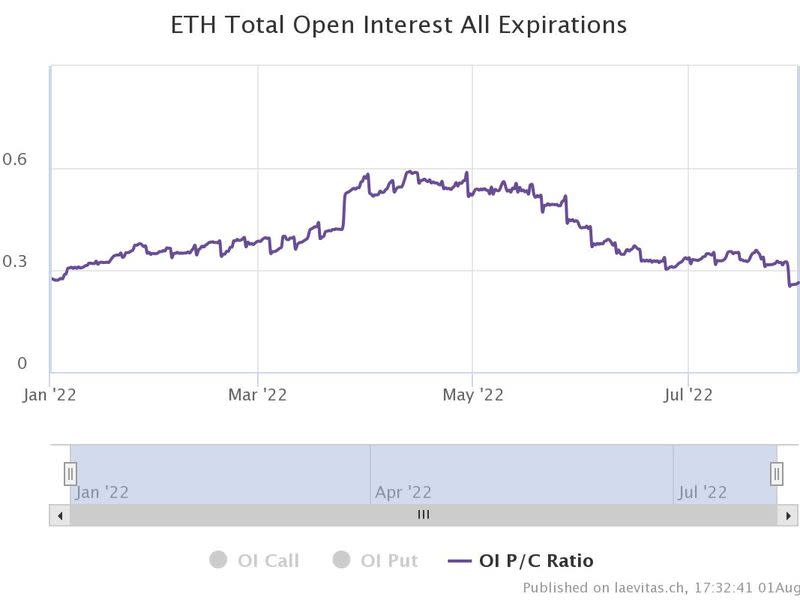

The increased demand for calls is evident from the sliding put-call open interest ratio, a measure of the number of open put positions relative to open call positions. Call options offer insurance against bullish moves, while put options provide protection against price drops.

"While some may be uncertain of the outcome of the Merge, at Deribit, we see a lot of post-Merge options open interest being created. Overall, put-call ratio is at a year low, indicating bullish momentum," Deribit Chief Commercial Officer Luuk Strijers told CoinDesk.

"BTC put-call ratio is at 0.5, while ETH put-call ratio is half of that at 0.26, and year-end expiry even again 50% lower at 0.12. The biggest ETH open interest is created in the December expiry call option at $3,000 strike." Strijers added.

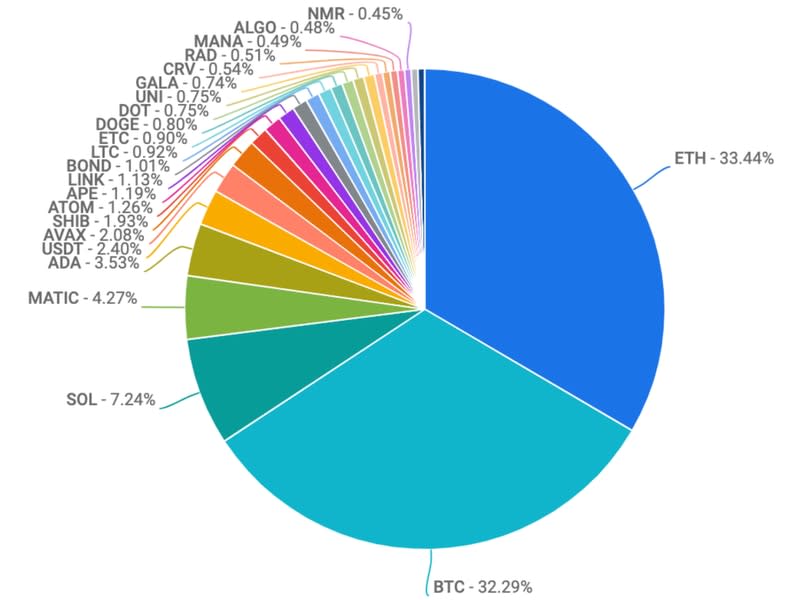

Activity in the ether spot market has picked up too, with the cryptocurrency recently toppling bitcoin as the most traded coin on the Nasdaq-listed crypto exchange Coinbase (COIN). While the ether trading volume accounted for 33.4% of the total turnover registered in the week ended July 29, the bitcoin trading volume accounted for 32%, with SOL in distant third place.

"Investors have looked to buy BTC as it hasn't kept pace with ETH and the broader complex. Additionally, we have seen renewed interest in SOL, MATIC, and AVAX," according to Coinbase's weekly market commentary published Friday.

That said, in terms of market valuation, ether, at $199 billion, is still half the size of bitcoin, whose market cap stood at $443 billion at press time. Some observers are confident that ether will soon replace bitcoin as the world's largest cryptocurrency by market value.

Further, ether continues to play second-fiddle to bitcoin in terms of daily trading volume in futures and options markets and open interest in the futures market. Per data provided by Skew, the notional open interest in ether futures was around $6 billion as of this writing. That's half the $12 billion in bitcoin futures.

Yahoo Finance

Yahoo Finance